NEW YORK (AP) — As Congress makes strides toward resolving the longest government shutdown in U.S. history, attention is shifting to the critical issue of expiring Affordable Care Act tax credits, which have made private health insurance affordable for millions of Americans. The recent legislative package, supported by Senate Republicans and some Democrats, does not provide a clear solution for continuing these vital subsidies, leaving many in uncertainty.

The current agreement only ensures a vote in December regarding the enhanced premium tax credits, which are set to lapse at the year's end without further action by lawmakers. House Speaker Mike Johnson, R-La, has not committed to facilitating a corresponding House vote, further diminishing the likelihood of extending these crucial subsidies.

Democratic lawmakers have attempted to reach compromise through one- or two-year stopgap measures aimed at preserving the subsidies, but so far, these efforts have not garnered the necessary support from Republican leadership.

On the other side of the aisle, some Republican lawmakers, along with former President Donald Trump, have expressed a desire to let these subsidies expire, suggesting alternative solutions like federal flexible spending accounts for citizens. As negotiations progress, the fate of the Affordable Care Act tax credits remains precarious, raising significant concerns for countless American enrollees.

The Potential Impact of Expiring Subsidies

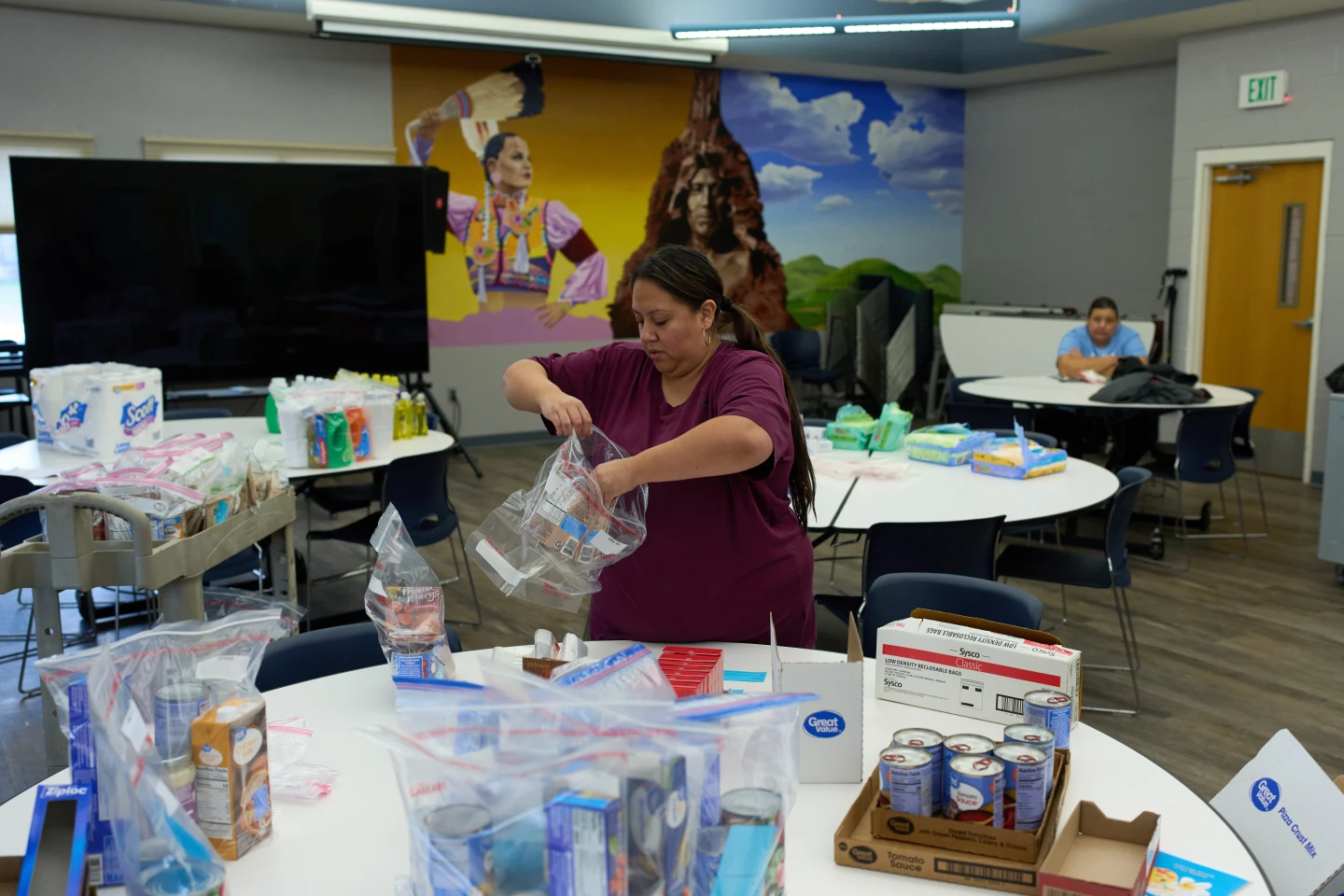

The new legislative package's passage, if unchecked by further action on healthcare costs, could result in the disappearance of enhanced premium tax credits that have supported individuals in affording healthcare for the past four years. According to an analysis by the health care nonprofit KFF, this change would more than double monthly premiums for subsidized enrollees on average, disproportionately affecting both higher and lower earners.

If the subsidies vanish, it would likely prompt a significant increase in costs for health insurance plans, as younger, healthier individuals opt out of expensive coverage, leading insurers to raise prices for the remaining insured population. The financial burden will also fall on hospitals and the government as uninsured individuals forgo preventive care and rely on emergency services.

Consequently, the implications of potential subsidy loss have already begun to resonate with Americans, as evident from reactions during the current health insurance enrollment period. One Pennsylvania resident has reported a $100 monthly increase in her insurance plan premiums as a direct consequence of these impending changes.

Options for Congress Moving Forward

While Republicans have, until now, avoided discussions on extending the expiring tax credits, the possibility of a congressional solution remains. A recent KFF poll noted that a substantial majority of U.S. adults, including a significant number of Republicans, would back efforts to extend these credits. If lawmakers do pursue a continuation of these subsidies, adjustments to existing insurance plans would need to be implemented promptly—a complex process that could become increasingly challenging over time.

Even if an extension occurs, prospective enrollees may already perceive next year's higher premium prices as out of reach. Experts caution that this could deter many from re-engaging with the market. Additionally, Congress may explore alternative avenues to reduce Americans' healthcare costs. Trump's proposals include using savings from not extending the subsidies for direct financial support to consumers, while Senate health committee chair Bill Cassidy has suggested pre-funded flexible spending accounts to enhance health service affordability.

As debates continue in a deeply polarized Congress, the fate of healthcare affordability for millions remains uncertain as stakeholders weigh the viability of proposed solutions.