JEFFERSON CITY, Mo. — A pressing question returns as state lawmakers convene for their sessions: to enact tax breaks linked to tips or overtime wages, or to resist the push from the federal government...

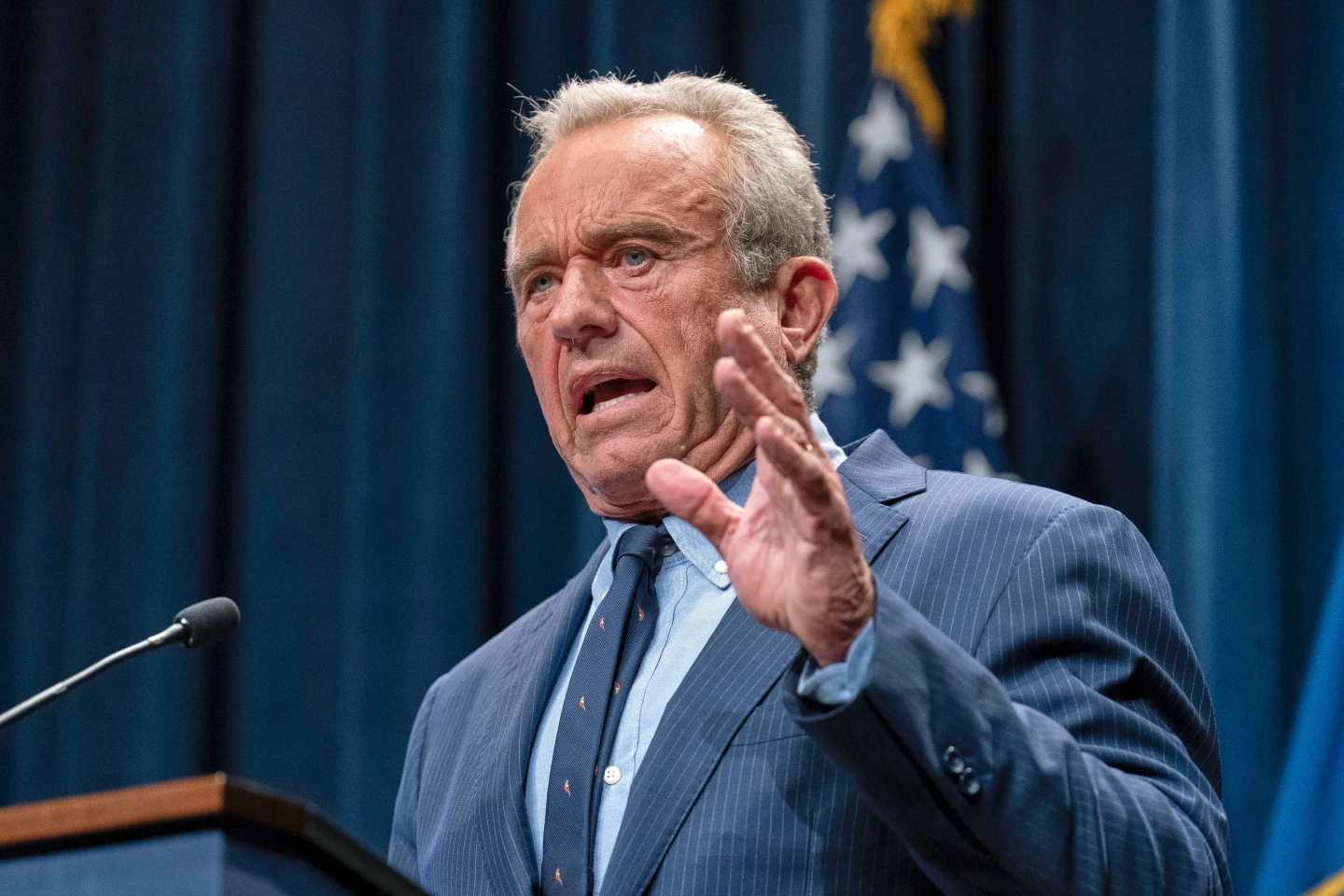

The Trump administration is advocating for states to adopt a host of tax breaks for individuals and businesses, which include deductions for tips and overtime wages...

While some states will automatically adapt to these federal tax changes, others require legislative action to implement them...

The potential benefits of these tax breaks present significant savings for residents and businesses but come with the downside of financial strain on state budgets...

Only a few states have adopted measures regarding these tax breaks, indicating a cautious approach among lawmakers to ensure fiscal responsibility...

This issue represents a crossroads for many lawmakers as they weigh the advantages of tax savings for constituents with the need for sustainable state funding...

As discussions unfold, the outcomes of these legislative decisions could have profound implications on state revenues and the economic landscape for taxpayers...