Netflix has agreed to buy the film and streaming businesses of Warner Bros Discovery for $72bn (£54bn) in a major Hollywood deal.

The streaming giant emerged as the successful bidder for Warner Bros ahead of rivals Comcast and Paramount Skydance after a drawn-out battle.

Warner Bros owns franchises including Harry Potter and Game of Thrones, and the streaming service HBO Max.

The takeover is set to create a new giant in the entertainment industry, but the deal will still have to be approved by competition authorities.

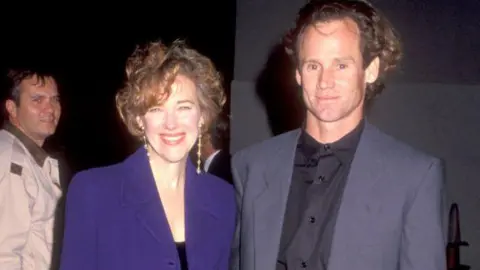

Netflix co-chief executive Ted Sarandos said the streamer was highly confident it would receive the regulatory approval it needs and was running full speed towards this.

He stated that by combining the library of Warner Bros shows and movies with Netflix's series such as Stranger Things, we can give audiences more of what they love and help define the next century of storytelling. Warner Bros have defined the last century of entertainment, and together we can define the next one, he added.

Ask about whether HBO should remain a separate streaming service, co-chief executive Greg Peters mentioned that Netflix believed the HBO brand was important for consumers but hinted that it was too early to discuss specifics regarding consumer offerings.

Netflix expects to find $2-3bn in savings, mainly from reducing overlaps in support and technology sectors.

Films made by Warner Bros will continue to be released in cinemas, and Warner Bros television studio will still produce for third parties. Meanwhile, Netflix will continue creating exclusive content for its platform.

Labeling it a big day for both companies, Mr. Sarandos acknowledged that the acquisition might have surprised some shareholders but saw it as a rare opportunity to set Netflix up for long-term success.

David Zaslav, Warner Bros president and CEO, emphasized that the collaboration would unite two of the greatest storytelling companies in the world.

The cash and stock deal is valued at $27.75 per Warner Bros share, with a total enterprise value of about $82.7bn.

Both companies’ boards unanimously approved the transaction, which is expected to expand Netflix’s production capacity and enhance its investment in original content.

The completion of the takeover will follow Warner Bros finalizing its earlier plans to separate streaming and studio divisions into publicly traded companies next year.

Hollywood Shake-up

Paolo Pescatore, founder and analyst at PP Foresight, regarded the sale as a significant statement of intent, highlighting Netflix’s ambitions as a leader in current streaming dynamics.

Despite the potential benefits, he cautioned that merging two massive entities could pose challenges for Netflix.

While the deal involves part of Warner Bros, rival Paramount sought to acquire the whole company, which Warner Bros ultimately rejected.

Tom Harrington, head of television at Enders Analysis, stated that the merger's success could vastly alter Hollywood, but there might be significant reductions in film and television production, leading to resistance from industry stakeholders.

Furthermore, a merger could result in higher consumer subscription prices, as Netflix aims to leverage its increasing market dominance.

Danni Hewson, head of financial analysis at AJ Bell, remarked that Netflix has promised to maintain theatrical releases for Warner Bros films, highlighting a collaborative approach to the integration.

As the regulatory review unfolds, how any potential cost savings might affect subscription prices will be closely monitored.

With additional reporting by Natalie Sherman

}