The price of gold has hit a record high of more than $4,000 (£2,985) an ounce as investors look for safe places to put their money over concerns about economic and political uncertainty around the world.

Gold has seen its biggest rally since the 1970s, rising by around a third since April when US President Donald Trump announced tariffs that have upset global trade.

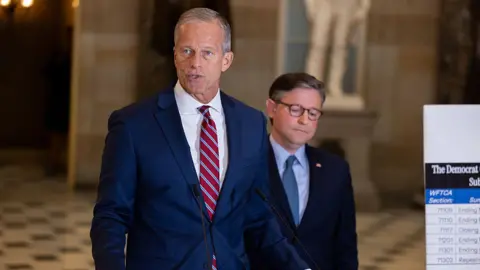

Another issue worrying investors is the delays to the release of key economic data due to the US government shutdown, which has entered its second week.

Gold is viewed as a safe haven investment expected to retain or increase value during market turbulence or economic downturns.

The price of spot gold climbed to more than $4,036 an ounce on Wednesday afternoon in Asia, with gold futures reaching the same level on 7 October. The recent government shutdown, driven by gridlock over public spending, has been a significant factor for rising gold prices, as noted by analysts.

Investor tendencies during past US government shutdowns indicate a shift toward safe-haven assets like gold, which rose nearly 4% during a previous month-long shutdown under Trump’s first term.

Nonetheless, price corrections could occur if the shutdown resolves more quickly than anticipated. Analysts from UOB have noted that the spike in gold prices has surpassed expectations, and is also influenced by a weakening US dollar and growing participation from retail investors, who have heavily invested in gold ETFs.

The trend is seen by many, including storage providers for precious metals, as a long-term shift. The founder of Silver Bullion stated that customer numbers have more than doubled, attracting retail investors, banks, and affluent families seeking security against global economic instability.

While gold has surged recently, its price is susceptible to fluctuations influenced by interest rate changes and shifts in geopolitical stability. Historical trends show that gold prices can drop significantly when economic conditions improve or inflation rises unexpectedly.

The current trajectory suggests that the Fed’s response to economic indicators could sustain gold’s appeal as a hedge against uncertainty, reinforcing its relevance during this tumultuous era.