Article Text:

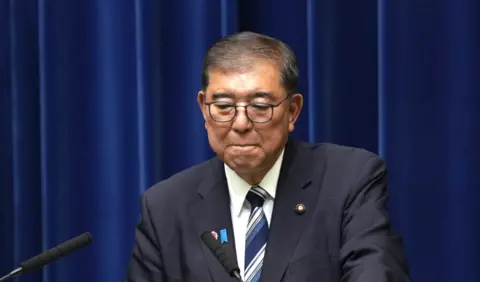

South Africa has plunged into a crisis marked by growing rifts within its coalition government, as divisions over the recently presented national budget escalate tensions. Analysts have described the situation as one of "uncharted waters," following Finance Minister Enoch Godongwana's budget announcement, which has triggered backlash from various factions of the coalition.

The ruling African National Congress (ANC), which formed a government of national unity (GNU) with nine parties after losing its parliamentary majority last year, is grappling with dissent from its largest coalition partner, the Democratic Alliance (DA). Without DA's support, the ANC faces significant hurdles in passing the budget, raising questions about the coalition's stability.

Godongwana's initial proposal, which included a controversial value-added-tax (VAT) hike – raising it from 15% to 17% – led to significant pushback, prompting a one-month delay in the budget’s presentation. This move was unprecedented since the end of apartheid in 1994. Upon his return, Godongwana unveiled a revised budget that proposes a more moderate increase to 16% implemented over two years. The minister stressed the importance of tax hikes to address pressing financial needs in health, education, and security.

Despite attempts to find a middle ground, the DA rejected the budget outright, demanding that any tax increases be temporary and strongly linked to substantial economic reforms. This deadlock has sparked criticism of President Cyril Ramaphosa, traditionally seen as a mediator, as only one minor party, the Patriotic Alliance (PA), has shown support for the budget.

The political landscape has become increasingly complex, particularly in light of opposition from prominent political factions, including the Economic Freedom Fighters (EFF) and Umkhonto weSizwe (MK), both of which argue the proposed tax increases will disproportionately affect the impoverished. Their stance has left the ANC in a precarious position, requiring cross-party negotiations to achieve a successful vote.

Analysts, such as Thokozile Madonko from Wits University, have emphasized the crucial role of parliament in this situation. With the ANC's ability to force policies through being severely challenged, they must broker agreements with other parties or risk a budget failure that could lead to a government collapse.

Critics have condemned Godongwana's budget strategy, arguing that increasing VAT is a simplistic approach that impacts the entire populace rather than imposing a targeted wealth tax to alleviate the burden on lower-income citizens. Another expert, Adrian Saville, expressed skepticism over the budget's promised fiscal allocations, urging the minister to provide concrete plans to combat the country's dire unemployment rate, which stands above 30%.

Once regarded as a capable and respected financial leader, Godongwana now faces pressing demands to navigate the budget through parliament successfully. Failure to do so may further erode his credibility and raise questions about his continued fit for the finance minister role amidst South Africa's tumultuous political climate.

South Africa has plunged into a crisis marked by growing rifts within its coalition government, as divisions over the recently presented national budget escalate tensions. Analysts have described the situation as one of "uncharted waters," following Finance Minister Enoch Godongwana's budget announcement, which has triggered backlash from various factions of the coalition.

The ruling African National Congress (ANC), which formed a government of national unity (GNU) with nine parties after losing its parliamentary majority last year, is grappling with dissent from its largest coalition partner, the Democratic Alliance (DA). Without DA's support, the ANC faces significant hurdles in passing the budget, raising questions about the coalition's stability.

Godongwana's initial proposal, which included a controversial value-added-tax (VAT) hike – raising it from 15% to 17% – led to significant pushback, prompting a one-month delay in the budget’s presentation. This move was unprecedented since the end of apartheid in 1994. Upon his return, Godongwana unveiled a revised budget that proposes a more moderate increase to 16% implemented over two years. The minister stressed the importance of tax hikes to address pressing financial needs in health, education, and security.

Despite attempts to find a middle ground, the DA rejected the budget outright, demanding that any tax increases be temporary and strongly linked to substantial economic reforms. This deadlock has sparked criticism of President Cyril Ramaphosa, traditionally seen as a mediator, as only one minor party, the Patriotic Alliance (PA), has shown support for the budget.

The political landscape has become increasingly complex, particularly in light of opposition from prominent political factions, including the Economic Freedom Fighters (EFF) and Umkhonto weSizwe (MK), both of which argue the proposed tax increases will disproportionately affect the impoverished. Their stance has left the ANC in a precarious position, requiring cross-party negotiations to achieve a successful vote.

Analysts, such as Thokozile Madonko from Wits University, have emphasized the crucial role of parliament in this situation. With the ANC's ability to force policies through being severely challenged, they must broker agreements with other parties or risk a budget failure that could lead to a government collapse.

Critics have condemned Godongwana's budget strategy, arguing that increasing VAT is a simplistic approach that impacts the entire populace rather than imposing a targeted wealth tax to alleviate the burden on lower-income citizens. Another expert, Adrian Saville, expressed skepticism over the budget's promised fiscal allocations, urging the minister to provide concrete plans to combat the country's dire unemployment rate, which stands above 30%.

Once regarded as a capable and respected financial leader, Godongwana now faces pressing demands to navigate the budget through parliament successfully. Failure to do so may further erode his credibility and raise questions about his continued fit for the finance minister role amidst South Africa's tumultuous political climate.