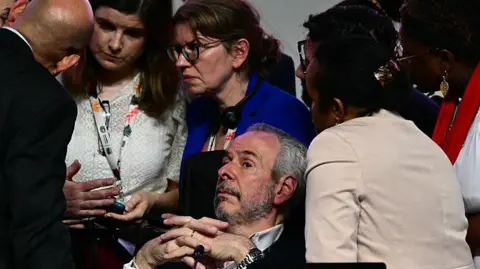

China's Ministry of Finance, under Finance Minister Lan Fo'an, declared on Saturday its intention to boost borrowing, aimed at aiding financially strained local governments and reinforcing state-owned banks. This strategic decision addresses the lingering real estate slowdown and fragile consumer confidence plaguing the economy. Although specifics on additional financing remain undisclosed for now, Minister Lan suggested details would emerge after procedural deliberations. This fiscal strategy aligns with previous stimulus efforts that invigorated Chinese stocks momentarily. However, recent stock declines indicate investor skepticism over the potential effectiveness of the government's current steps.

In the wake of the ongoing housing market crash, state-owned banks reportedly faced substantial losses, although few have been publicly acknowledged. To mitigate this, Finance Ministry plans include capital injections into the largest banks, ensuring these institutions can continue providing essential credit. Furthermore, local governments are encouraged to raise funds by selling assets, though hesitations persist due to declining property values. Additionally, the ministry reiterated its commitment to examining municipal spending practices, addressing concerns that financial mismanagement might have exacerbated economic challenges for state enterprises and local entities.

In the wake of the ongoing housing market crash, state-owned banks reportedly faced substantial losses, although few have been publicly acknowledged. To mitigate this, Finance Ministry plans include capital injections into the largest banks, ensuring these institutions can continue providing essential credit. Furthermore, local governments are encouraged to raise funds by selling assets, though hesitations persist due to declining property values. Additionally, the ministry reiterated its commitment to examining municipal spending practices, addressing concerns that financial mismanagement might have exacerbated economic challenges for state enterprises and local entities.