Nike has announced plans to raise prices for certain trainers and clothing effective June 1, echoing similar sentiments from competitor Adidas, who recently signaled potential price increases due to uncertainty surrounding US tariffs. Although Nike did not directly link the impending price hikes to tariffs, it is known that a sizable portion of their products is manufactured in Asia—a region impacted by trade policies implemented during Donald Trump's presidency.

Currently, the US has put higher "reciprocal" tariffs on hold until July, yet a baseline tariff of 10% remains on a range of imports. Typically, import duties burden the importing company, pushing them to either absorb the costs or pass them onto consumers. Nike's adjustments include a potential $10 increase on shoes priced over $100 and a $2 to $10 rise for clothing items.

Nike stated, “We regularly evaluate our business and make pricing adjustments as part of our seasonal planning.” As of now, the company has not confirmed whether these price changes will affect markets outside the US. Notably, popular items such as the Air Force 1 trainers and products priced under $100, including some children's items, will remain exempt from these hikes.

The announcement comes alongside Adidas's warning of the impact that tariffs would have on US prices for popular models like the Gazelle and Samba. UK sportswear retailer JD Sports also expressed concern that tariff-induced price increases might dampen consumer demand in a critical market.

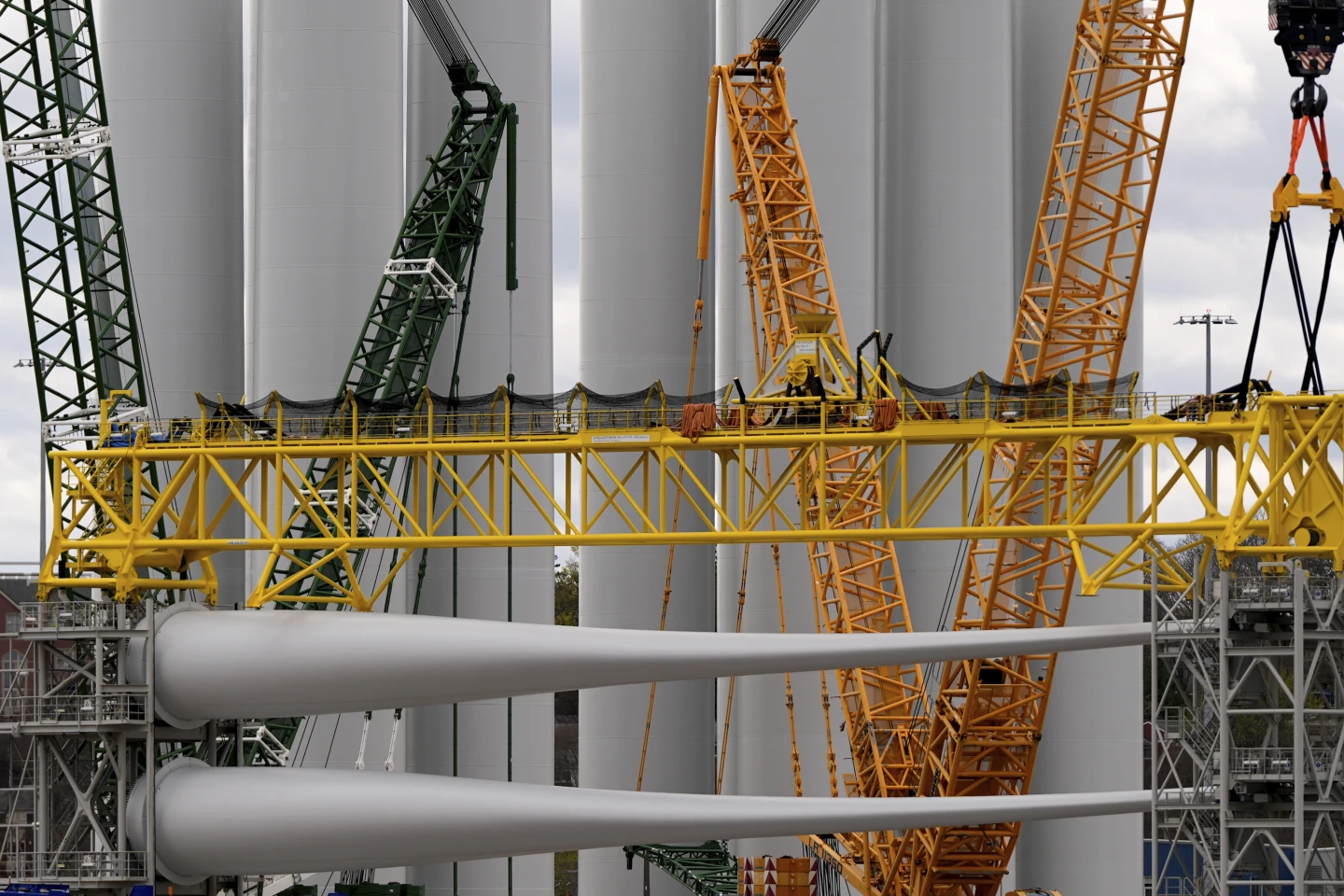

The ongoing tariff situation is the result of complex negotiations between the US and various manufacturing countries, including China, Vietnam, Thailand, and Indonesia—each facing substantial import taxes ranging from 32% to 54%. The tariffs have significant implications for manufacturers in Vietnam, which produces a majority of Nike's products—50% of its footwear and 26% of clothing.

As a recent development, Nike has begun selling goods directly on Amazon for the first time since 2019, stepping away from its previous strategy of focusing solely on its own retail channels. Despite this shift, Nike has reported a decline in online sales, including a substantial 25% drop in Europe, the Middle East, and Africa, alongside a 20% fall in Greater China.

As global businesses continue to adapt to evolving tariff scenarios and the complexities of international trade policy, the impact on consumer prices and company strategies remains to be fully seen.